- Visit the FCTIRS Self Service Portal at fcttaxportal.fctirs.gov.ng/selfservice/account/signin

- Enter your TIN and password to login or click on the register button in case you are yet to register and follow the registration process

- Click on the Menu button and Select Tax Returns

- On the Tax Returns click on the File Returns

- Click on File a New Return button

- On the New Return Page, enter assessment date and assessment year and click on Generate Returns Reference Number button

- On the Assessment Page enter the required information on part A, B, C, and D and submit your filling for approval.

What is the area of jurisdiction of FCT-IRS?

FCT-IRS collects taxes from individuals residing in FCT.

Where is FCT-IRS located?

FCT-RS has several offices across the Federal Capital Territory. Taxpayers are advised to conduct business with the tax office nearest to their location. Below are FCT-IRS’ office locations;

| Office Name | Address | Location | |

| Headquarters | info@fctirs.gov.ng | No 3, Abriba Close, off Yola Street, Area 7, Garki, Abuja. | locate |

| Office of Director Tax/Tax Operations Department | tax@fctirs.gov.ng | No 3, Abriba Close, off Yola Street, Area 7, Garki, Abuja. | locate |

| Asokoro/IPPIS Tax Office | asokoro@fctirs.gov.ng ippis@fctirs.gov.ng | No. 11, Kwame Nkrumah Crescent, Asokoro, Abuja. | locate |

| Bwari Tax Office | bwari@fctirs.gov.ng | No. 5, Justice Charles Ogueni Action Layout, Bwari Area Council, Abuja. | locate |

| Central Area Tax Office | centralarea@fctirs.gov.ng | Abia House, Plot 979, First Avenue, Ahmadu Bello Way, Central Business District, Abuja. | locate |

| Garki Tax Office | garkiArea11@fctirs.gov.ng | Plot 1300 Funmilayo Ransome Kuti Road Area 3 Garki Abuja beside Shafa Filling Station (By Rita Lori Hotels). | locate |

| Gwagwalada Tax Office | gwagwalada@fctirs.gov.ng | No. 8, Hon. Friday Itula Road, along Custom Training School, Phase 2, Gwagwalada, Abuja | locate |

| GwarinpaTax Office | gwarimpataxoffice@fctirs.gov.ng | No.1, 69(A) Road, 31 Crescent Gwarinpa Estate, Abuja. | locate |

| Karu Tax Office | karu@fctirs.gov.ng | No. 30, Eggon Crescent, Off Biroms Street, Karu, Abuja. | locate |

| Kaura Tax Office | kaura@fctirs.gov.ng | No. 8, FCT-IRS Drive, Off Oladipo Diya Way, Behind NNPC Filling Station, Kaura, Abuja. | locate |

| Kubwa Tax Office | kubwataxoffice@fctirs.gov.ng | No. 5, Gabriel Oyibode Street, Extension 3, Kubwa, Abuja. | locate |

| Kuje Tax Office | kuje@fctirs.gov.ng | No. 2, High Court Road, Kuje, Abuja. | locate |

| Lugbe Tax Office | lugbe@fctirs.gov.ng | No. 220, Sector F, Opposite FHA Mortgage Bank, Lugbe, Abuja. | locate |

| Maitama Tax Office | maitama@fctirs.gov.ng | No. 20 , Lake Chad Crescent, Maitama, Abuja. | locate |

| MDA Tax Office | mdas@fctirs.gov.ng | Plot 1300 Funmilayo Ransome Kuti Road Area 3 Garki Abuja beside Shafa Filling Station (By Rita Lori Hotels) | locate |

| Utako Tax Office | utakotaxoffice@fctirs.gov.ng | No 21, I.B.M Haruna Street, Utako, Abuja. | locate |

| Wuse Tax Office | wuse@fctirs.gov.ng | No 4,Buchana close, off Buchana crescent, off Aminu Kano crescent, behind Ruby Centre, Wuse Zone 2, Abuja. | locate |

Where should PAYE deduction of staff working in Abuja but residing in Suleja or Mararaba be remitted to?

By residency rule, an employee’s PAYE is payable to the Tax Authority of his/her place of residence. It is therefore the duty of the employer to deduct and remit PAYE to the Tax Authority where the employee is resident, that is Niger State Internal Revenue Service or Nasarawa State Internal Revenue Service respectively.

How do I apply for TIN?

- Individuals: Click on the link to register https://tin.jtb.gov.ng/TinIndividualRequestExternal

- Non-Individuals: Click on the link to register https://tin.jtb.gov.ng/TinRequestExternal

Steps on TIN Registration

Individual TIN Registration Process

Step 1: Open your browser and go to: fctirs.gov.ng on the home page and click on register for TIN individual, you will be redirected to https://tin.jtb.gov.ng/TinIndividualRequestExternal or download JTB App on your mobile phone (Andriod or IOS)

Step 2: Enter your BVN, date of birth, first name and Last name, confirm you are not a robot by checking the reCAPTCHA box. and click on search.

Note: Ensure the BVN details entered corresponds exactly with your BVN SLIP.

Step 3: Fill out the registration form and click submit. Upon completion of the registration process, your TIN request will be approved and the TIN certificate will be sent to your email.

Corporate TIN registration process for Corporate entity registration

Step 1: Open your browser and go to: fctirs.gov.ng on the home page and click on register for TIN non-individual, you will be redirected to https://tin.jtb.gov.ng/TinRequestExternal or download JTB App on your mobile phone ( Andriod or IOS)

Step 2: Provide Business name Number

Step 3: Fill out the registration form and click submit. Upon completion of the registration process your TIN request will be approved and the TIN certificate will be sent to your email.

How much do I pay for TIN?

TIN generation is free of charge.

I have lost my TIN. How do I retrieve it?

You can use the USSD code *7737*22# using your registered phone number to retrieve your TIN. You can also use your BVN or NIN if you dial the code using a different phone number.

How do I update my taxpayer information?

You can send that information to contactus@fctirs.gov.ng and attach evidence of what you want to update. You may also visit any FCT-IRS tax office to update your details.

I have a TIN that begins with ‘6000’ and I get an invalid TIN message when attempting to make payment. What do I do?

You can visit your nearest tax office for resolution of the issue.

I have been asked to provide my TIN to Customs for the importation of goods. However, my TIN is not being validated. What do I do?

For importation, Customs only recognises FIRS TIN. Therefore, visit any FIRS tax office and get a TIN for that purpose.

I have been asked to provide my TIN by a Government agency for payment via GIFMIS. However, my TIN is not being validated. What do I do?

Only FIRS TIN can be used on the GIFMIS platform. Therefore, visit any FIRS tax office and get a TIN for that purpose.

How do I make payment to FCT-IRS?

Payments to FCT-IRS can be made via the Remita platform either online or at any commercial bank.

I find it difficult to generate remita RRR. Can’t I pay my tax without generating remita RRR?

RRR is required for payments made on remita. Follow the steps below to generate an RRR

- On any web browser, visit www.remita.net

- Under Name of service/purpose, select the tax you want to pay.

- Fill out the required information and click Submit.

- In the window that displays, select your preferred method of payment. To pay at the bank, select Bank Branch and copy the displayed RRR.

Is cash payment accepted at the tax office?

No. All payments can be done either electronically or at the Bank.

I paid the wrong tax type. What do I do?

Submit a written complaint at your tax office detailing the tax you paid and the intended tax type.

What is the due date for filing individual returns?

All individual taxpayers are required to file their tax returns on or before 31st March of every year.

What is the due date for filing annual returns for Pay-As-You-Earn (PAYE) by employers?

All employers of labour are required to file their tax returns on or before 31st January of every year in respect of all employees in its employment in the preceding year.

Is there a penalty for failing to file my returns?

The penalty for failure to file returns according to the Personal Income Tax (Amendment) Act, 2011 is N500,000 for corporate organizations and N50,000 for individuals.

How do I file my returns?

You may visit any FCT-IRS tax office to pick up the necessary forms, or download them at www.fctirs.gov.ng/downloads. Employers are required to submit a schedule containing the details of their PAYE remittances using a template available on www.fctirs.gov.ng/downloads.

Steps on Filling Returns using Self Service Portal

How do I apply for a Tax Clearance Certificate (TCC)?

You will be required to provide the following;

- Written application for TCC addressed to the Tax Controller of your FCT-IRS tax office.

- Completed Form A, which can be downloaded from www.fctirs.gov.ng/downloads or collected at the tax office.

- Photocopy of previous TCC if any, OR, evidence of your income for 3 years (ex. Payslip).

What is the validity period of a TCC?

A TCC is valid up until the 31st day of December of the issuing year. However, FCT-IRS reserves the right to issue a restricted TCC with a shorter validity period.

How long does it take to obtain a TCC after submitting a request?

It takes a maximum of 14 days to obtain a TCC. However, the time it takes is usually much shorter.

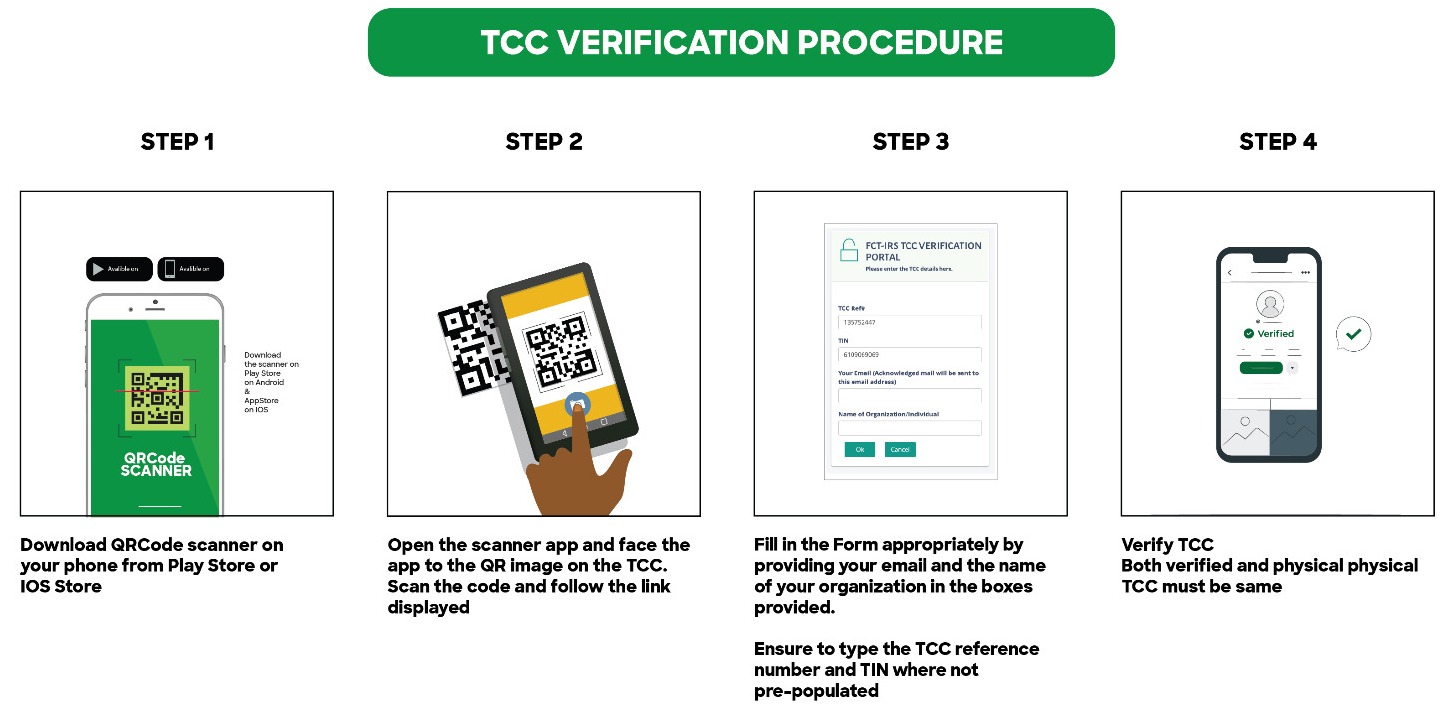

How can I verify a TCC?

Write a letter to FCT-IRS requesting for confirmation of the genuineness of the TCC in question.

or follow the steps below.

What is Personal Income Tax (PIT)?

It is a tax levied on all incomes of an individual in employment or business. All employers of labour are expected to deduct taxes from their employees and remit same to the tax authority on a monthly basis, while persons in business are expected to file their annual returns and pay accordingly.

Who should pay Personal Income Tax?

Any person who earns income in the form of salary, wage, fee, allowance or other gains or profit from employment including compensations, bonuses, premiums, benefits or other perquisites allowed, given or granted by any person to any temporary or permanent employee other than so much of any sums as or expenses incurred by him in the performance of his duties, and from which it is not intended that the employee should make any profit or gain.

Are temporary or casual workers meant to pay tax?

Yes. The Personal Income Tax (Amendment) Act, 2011 combined with the provisions of S.3 (1)(b) and S.3(1)(b)(i) particularly defining the taxpaying employee as either a temporary or permanent employee.

What items are exempt from tax?

In addition to the Consolidated Relief Allowance (CRA), the following items in the Sixth Schedule table are still tax exempt;

- National Housing Fund Contribution

- National Health Insurance Scheme

- Life Assurance Premium

- National Pension Scheme

- Gratuities

What are the rates to use in computing my taxes?

After the relief allowance and exemptions have been granted, the balance of income shall be taxed as specified in the following Sixth Schedule Table.

- First N300,000 @7%

- Next N300,000 @ 11%

- Next N500,000 @ 15%

- Next N500,000 @19%

- Next N1,600,000 @ 21%

- Above N3, 200,000 @ 24%.

What is Pay-As-You-Earn (PAYE)?

PAYE is an acronym for “Pay-As-You-Earn”. It is a method of collecting personal income tax from employees’ salaries and wages through deduction at source by an employer as provided by the relevant Sections of Personal Income Tax Act (PITA). (S.81 of Personal Income Tax Act Cap P8, LFN 2004).

What is the difference between PAYE and Direct Assessment?

PAYE and Direct Assessment are two ways of assessing individuals to tax. PAYE is for individuals under paid employment and Direct Assessment is for Self Employed individuals.

Can I use withholding taxes deducted on me to offset my Personal Income Tax liability?

Yes, Withholding Taxes is recognized as part of taxes paid and can be net off from liability assessed for the year and balance is paid.

What is the due date for remitting PAYE?

The due date for remitting PAYE is the 10th day of every month following the month of deduction.

What is Gross Income?

Gross income for personal relief purposes has been redefined as income from all sources less non-taxable income, exempt items and income on which no further tax is payable. In the case of an enterprise, less all allowable business expenses and capital allowance.

Is the submission of comprehensive list of staff with PAYE deductions different from submission of annual returns?

Yes. A comprehensive list of employees with PAYE deductions (PAYE schedule) is continuously submitted on monthly basis each time PAYE is remitted to FCT-IRS, while annual returns (form H1) is submitted on or before 31st day of January of every year and payments of tax have been made for the previous year for all its employees.

Are minimum wage earners exempt from paying tax?

Low-income earners earning minimum wage of 30,000.00 Naira or less have been exempted from paying personal income tax.

When there is under deduction of tax in the employee’s income /salary, who bears the burden of the under deduction?

When there is an under deduction of tax in staff salary, the employer who under-deducted the tax is bears the burden.

What are the other taxes and revenue items are collected by FCT-IRS and their rates?

| S/N | Sources of Revenue | Rates /Fees Charged | Remarks |

| 1 | Withholding Tax (WHT) on Dividends | 10% | For individual |

| 2 | Withholding Tax (WHT) on Director’s/Management Fees | 10% | |

| 3 | Withholding Tax (WHT) on Interest | 10% | For individual |

| 4 | Withholding Tax (WHT) on Rent | 10% | Rent paid/ received |

| 5 | Withholding Tax (WHT) on Consultancy and Technical Services for individual | 5% | Advanced deduction before contract payment |

| 6 | Withholding Tax (WHT) on Commission | 10% | To individual |

| 7 | Withholding Tax (WHT) on Construction Contracts for individual | 5% | Advanced deduction before contract payment |

| 8 | WHT on Income from all aspects of building and other civil works construction | 5% | For individual |

| 9 | WHT on Income from Contracts other than outright sales and Purchase of goods and property in the ordinary course of business | 5% | For individual |

| 10 | Capital Gains Tax (Individuals) | 10% | Differences in the purchase, improvement and sale amount |

| 11 | Stamp Duties on Instruments Executed by individuals | Flat rate (fromN50.00 to N500.00) Ad Valorem (from 0.075% – 1.5%) | |

| 12 | Pools Betting and Lotteries, Gaming and Casino | 10% of winning | |

| 13 | Business Premises Registration Fees | 10,000 for Urban – First Year reg. 7,500 for Rural – First Year reg. 5,000 for Urban Annual Renewal 2,000 for Rural Annual Renewal | |

| 14 | Development Levy | N100.00 per person | Annual levy per individual |

| 15 | Naming of Street Registration Fees in the Federal Capital City Abuja | ||

| 16 | Right of Occupancy Fees on Lands owned by the State Government in Urban Areas of the FCT | ||

| 17 | Property Tax | Charged on the value of the property against the land | Valuation required |

| 18 | Entertainment and Event Centre Tax | 5% | Consumption |

| 19 | Market Taxes and Levies where FCT Finance is Involved |

What is benefit in – kind?

Benefit in kind is defined as those benefits that accrue to a person by reason of office and/or position he/she occupies. Benefit in kind include such benefit as official car, house accommodation, cooks, gardeners, security personnel, etc. It is taxable after certain deductions or reliefs have been granted.